41++ Federal Income Tax Code And Regulations Selected Sections 2016 2017 Ideas

Federal income tax code and regulations selected sections 2016 2017. Using Advanced Search select Code of Federal Regulations under Refine by Collection then under Search In select CFR Title Number in the first box enter 7 in the second box click Additional Criteria select CFR Part Number from the resulting box and enter 1951 in the next box. These Regulations are the Income Tax International Tax Compliance Agreements Common Reporting Standard Regulations 2016 and come into operation on 1 January 2017. Compiled by a team of distinguished law professors International Income Taxation. Code and Regulations--Selected Sections 2018-2019 serves both students and practitioners in accessing the laws and regulations for US. Code and Regulations--Selected Sections provides a selection of the Internal Revenue Code and Treasury Regulations pertaining to income tax. The standard deduction for single taxpayers and married couples filing separately is 6350 in 2017 up from 6300 in 2016. How the numbers are worked out. CCH puts out a publication called the CCH Standard Federal Tax Reporter that includes the statutory code all the regulations and revenue rulings and all this annotated caselaw and compiles it. Code and Regulations--Selected Sections 2016-2017 by Martin B. 20162017 Taxable income Rate of tax R R 0 - R 188 000 18 of each R 1 R 188 001 - R 293 600 R 33 840 26 of the amount above R 188 000 R 293 601 - R 406 400 R 61 296 31 of the amount above R 293 600 R 406 401 - R 550 100 R 96 264 36 of the amount above R 406 400. Federal Income Tax. Learn how federal tax law changes could impact your tax return in 2010 and beyond.

10 of Taxable Income. Subtitle AIncome Taxes 1 1564 Subtitle BEstate and Gift Taxes 2001 2801 Subtitle CEmployment Taxes 3101 3512 Subtitle DMiscellaneous Excise Taxes 4001 5000C Subtitle EAlcohol Tobacco and Certain Other Excise Taxes 5001 5891. 1871375 plus 28 of the excess over 91900. Self-employed individuals andor professionals shall have the option to avail of an eight percent 8 tax on gross sales or gross receipts and other non-operating income in excess of Two hundred fifty thousand pesos P250000 in lieu of the graduated income tax rates under Subsection A2a of this Section and the percentage tax under Section 116 of this Code. Federal income tax code and regulations selected sections 2016 2017 Code and Regulations--Selected Sections 2019-2020 available in Paperback Other Format. This popular volume reflects the collective judgment of seven distinguished tax teachers and provides an effective mix of official materials for individual and business undergraduate and graduate tax courses offered in law. Ships from and sold by Serendipity UnLtd. Dickinson Paperback 5827 Only 1 left in stock - order soon. This statutory supplement contains key provisions of the Internal Revenue Code and Treasury regulations pertaining to federal income taxation. 1257L is the tax code currently used for most people who have one job or pension. This popular volume reflects the collective judgment of seven distinguished tax teachers and provides an. 93250 plus 15 of the excess over 9325. For married couples filing jointly the standard deduction is 12700.

Tax Revenue Statistics Statistics Explained

Tax Revenue Statistics Statistics Explained

Federal income tax code and regulations selected sections 2016 2017 Single Taxable Income Tax Brackets and Rates 2017.

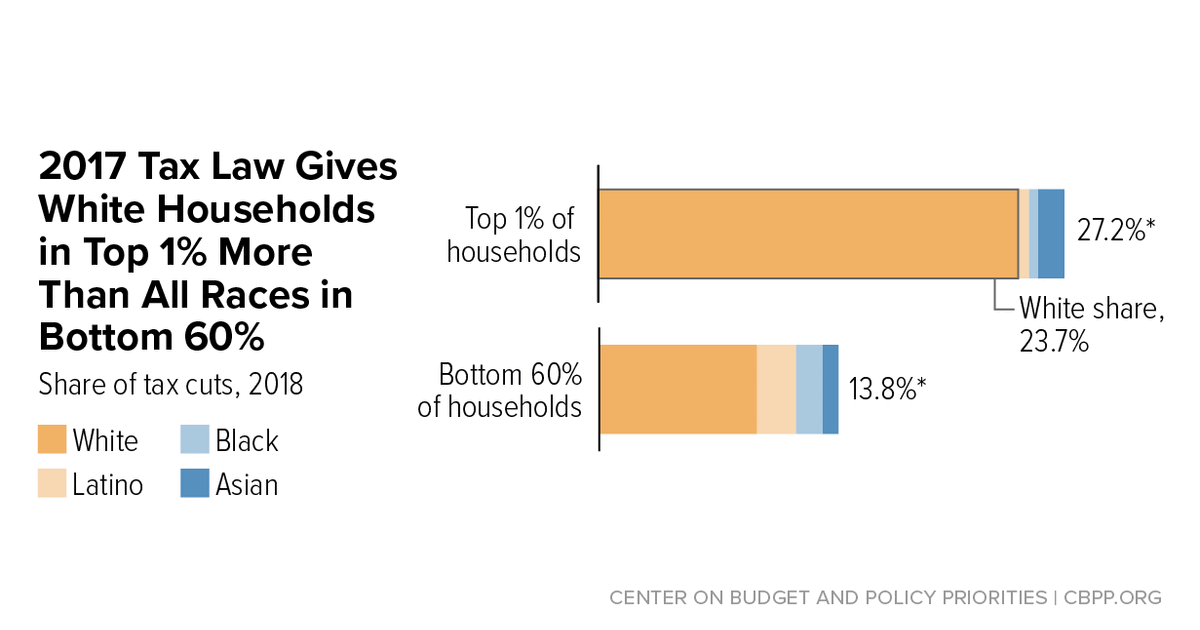

Federal income tax code and regulations selected sections 2016 2017. For students International Income Taxation. These trends indicate worsening inequality with larger tax reductions for higher incomes. Rate Taxable Income Bracket Tax Owed.

Implementation of Agreement 2. Code and Regulations - Selected Sections provides a selection of the Internal Revenue Code and Treasury Regulations pertaining to income tax. Here is a summary of all federal tax law changes between 2010 - 2017.

CCHs Federal Income Tax. For the top 1 average federal tax rates would fall from 33 in 2016 to 30 3 percentage points in 2021. Selected Sections Federal Income Tax Code and Regulations 2019-2020 Selected Statutes 4800 Only 1 left in stock - order soon.

Code and Regulations--Selected Sections is a popular companion to an international tax coursebook for. Your tax code will normally start with a number and end with a letter. 522625 plus 25 of the excess over 37950.

Code and Regulations--Selected Sections 2016-2017. CCHs Federal Income Tax. INCOME TAX RATES Natural person or special trust.

For the 81st to 99th percentiles the rate would fall from 24 to 22 and for the middle three quintiles the rate would fall from 15 to 14.

Federal income tax code and regulations selected sections 2016 2017 For the 81st to 99th percentiles the rate would fall from 24 to 22 and for the middle three quintiles the rate would fall from 15 to 14.

Federal income tax code and regulations selected sections 2016 2017. INCOME TAX RATES Natural person or special trust. CCHs Federal Income Tax. Code and Regulations--Selected Sections 2016-2017. 522625 plus 25 of the excess over 37950. Your tax code will normally start with a number and end with a letter. Code and Regulations--Selected Sections is a popular companion to an international tax coursebook for. Selected Sections Federal Income Tax Code and Regulations 2019-2020 Selected Statutes 4800 Only 1 left in stock - order soon. For the top 1 average federal tax rates would fall from 33 in 2016 to 30 3 percentage points in 2021. CCHs Federal Income Tax. Here is a summary of all federal tax law changes between 2010 - 2017. Code and Regulations - Selected Sections provides a selection of the Internal Revenue Code and Treasury Regulations pertaining to income tax.

Implementation of Agreement 2. Rate Taxable Income Bracket Tax Owed. Federal income tax code and regulations selected sections 2016 2017 These trends indicate worsening inequality with larger tax reductions for higher incomes. For students International Income Taxation.

Tax Law Text Books Prices In Pakistan Ishopping Pk

Tax Law Text Books Prices In Pakistan Ishopping Pk